Tds Ratio Formula

Total debt service tds your tds ratio is the percentage of your income needed to cover all of your debts.

Tds ratio formula. In the formula tds is measured in mg l ec is the conductivity of your sample the reading from your electrical conductivity meter and ke is the correlation factor. Tdsr formula to calculate a borrower s tdsr use the following formula. Gross debt service ratio mortgage payments property taxes heating costs 50 of condo fees. However the evaluation is only partly over.

The debt ratio formula calculation is the same as that of the gds except all of your monthly debts are taken into consideration. Property related loans including the loan being applied for. Your tds should not be higher than 40. Gross debt service ratio is calculated by the sum of your housing costs mortgage payments property taxes heating and condo fees divided by your annual income.

As an example consider two married law students who have a monthly mortgage payment of 1 000 and pay annual property taxes of 3 000 with a gross family. Total debt service ratio is calculated by the the gross debt above housing mortgage property etc debt and loan. You still need to have your tds evaluated. The total debt service ratio.

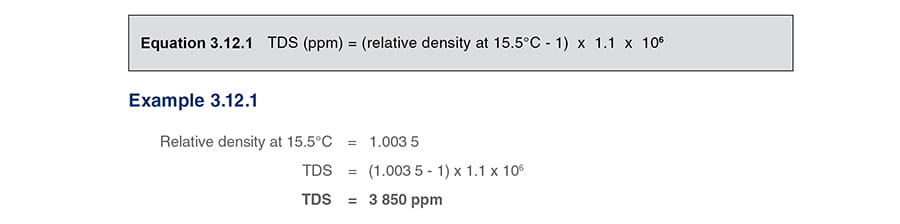

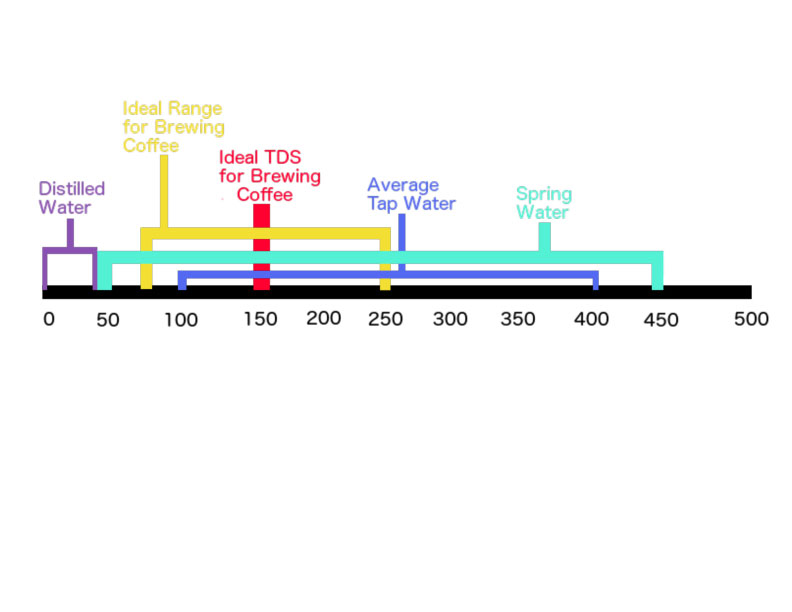

News about how to calculate tds from salary. The basic formula for calculating total dissolved solids looks like the above illustration. Borrower s total monthly debt obligations borrower s gross monthly income x 100 monthly debt obligations tdsr numerator monthly debt includes all outstanding debt obligations. Total debt service tds total debt service ratio is the percentage of your gross income that is required to cover housing costs and any other debt.

Cmhc restricts debt service ratios to 35 gds and 42 tds. Your gross debt service ratio gds and your total debt service ratio tds. Plug your data into the tds formula. The industry standard for a tds ratio is.

The two calculations a lender does are. Principal interest taxes heat other debt obligations gross annual income. Example of gross debt service ratio. Total debt service ratio formula.

This includes car payments credit cards alimony and any loans. Housing costs and any other debts. Payments should be based on the applicable amortization period and loan amount including the cmhc premium. To see how both calculations work watch the video and read more below.

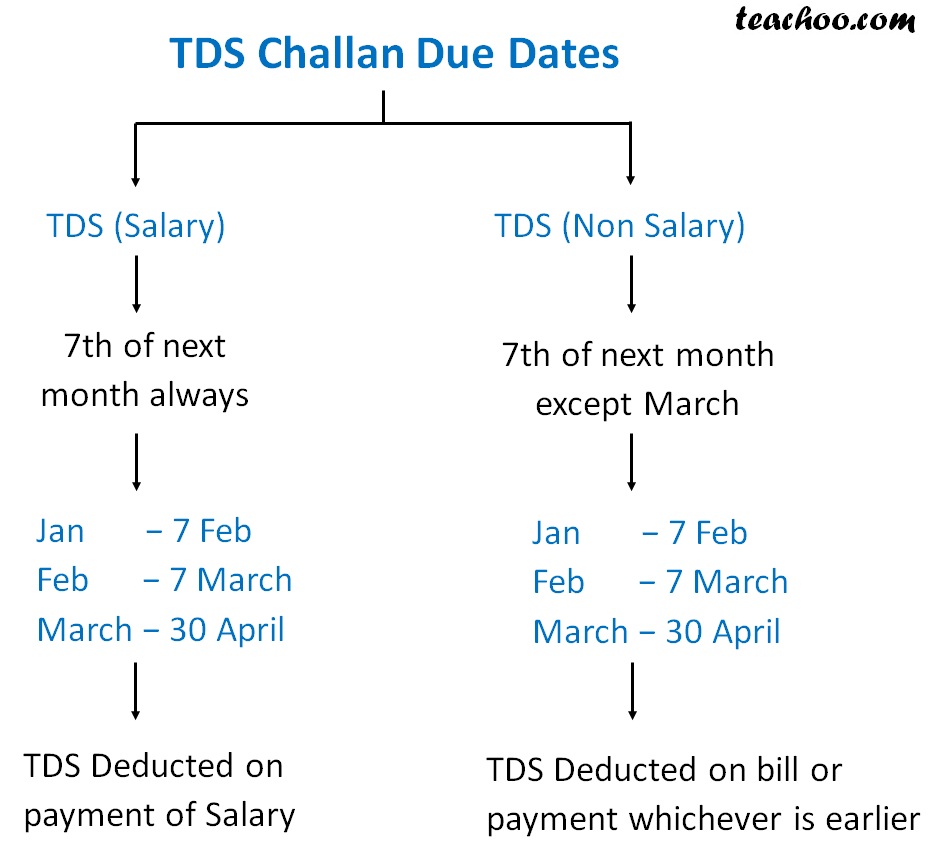

For tds from salary you will have to choose your tax regime now says cbdt circular. According to a circular by the central board of direct taxes cbdt it has been clarified by the finance ministry that an employer will have to deduct tds for fy2020 21 from an employee s salary on the basis of the new lower tax regime if opted by the employee.